Bitcoin’s technology and ideals have given people refuge from the corruption of central banking and government bailouts. We witnessed a grassroots movement that rallied overtime, and has grown to the point that it can no longer be ignored. Bitcoin has laid the foundations for an entirely new industry, however it faces certain issues that come from being the first of its kind. Bitcoin is technologically immature and faces difficulties in adapting to social and economic realities within a quickly changing world.

The Ergo network is the ideological and technological successor of Bitcoin. Ergo shares a similar grassroots beginnings with a focus on research and development over marketing and currency (ERG) price. Ergo is a leader in innovation. Like Bitcoin, Ergo is built with the ideals of financial sovereignty, but with the ability to more easily adapt through miner consensus.

The Ergo network is a decentralized protocol with Turing complete smart contracts and solutions for scaling, privacy, and network longevity. ERG is the native asset paid to miners for providing security and will have a fixed maximum supply of 97,739,925.

Distribution and Decentralization

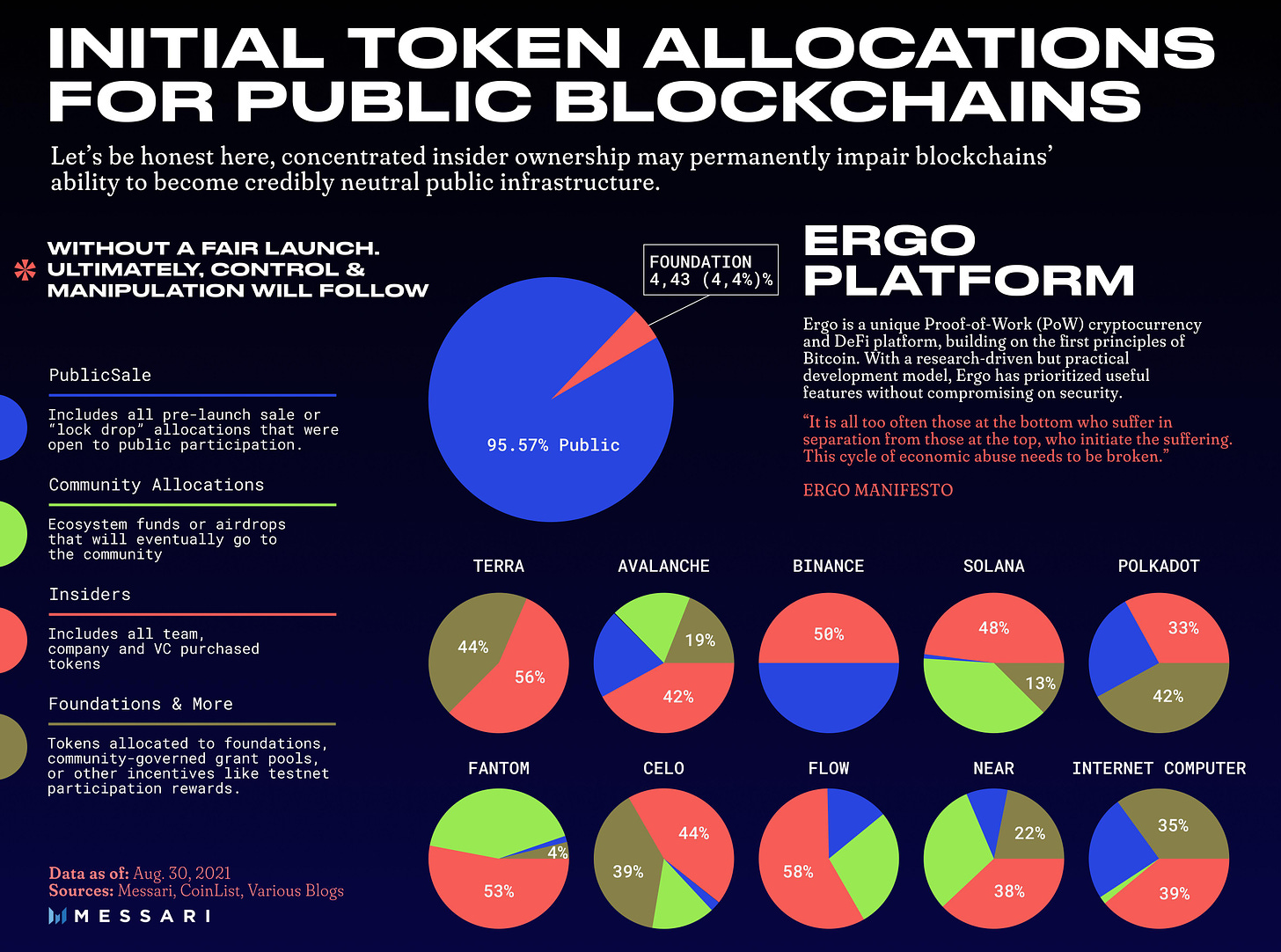

Although it may seem obvious that distributed systems need fair initial token allocations to ensure that protocols remain appropriately decentralized and trustless, many projects have relatively centralized beginnings. When the initial token allocation is concentrated to insiders and venture capital firms, the resultant power structures will have similar power dynamics to the current centralized financial sector. The initial distribution is especially important in Proof of Stake protocols where stakers are the decision makers. Centralized distributions will result in networks controlled by insiders and early investors.

Ergo is a Proof of Work protocol where the decision making is performed by miners and not token holders. This consensus model is already protective against unfair power dynamics arising from pre-mining coin for insiders. That being said, the Ergo had a fair launch. There was no pre-mine, initial coin offering, or pre-allocation of tokens to any team members or venture capitalists. The Ergo Foundation allocated 4.43% of the token supply for ecosystem development. To put this into perspective, Bitcoin creator Satoshi Nakamoto owned as many as 1.1 million Bitcoin or about 5.2% of the initial token supply. The figure below also shows the differences in token distribution between Ergo and other popular projects.

Consensus with Proof of Work

The importance of using Proof of Work cannot be understated. This consensus mechanism is the most researched and has been stress tested through user adoption for over a decade now. The economics of Proof of Work are more resilient against centralization when compared to newer consensus mechanisms such as Proof of Stake.

Important distinctions between the two are who owns the network and the associated cost of decision-making. In Proof of Work, the network is owned by miners who incur a continuous cost to provide security and make decisions. In Proof of Stake, the ownership is based on the amount staked and so the cost is fixed. In both consensus models those that provide security earn block rewards as revenue.

There are also differences in the economics of both consensus mechanisms. Proof of Work has a distinction between network and coin ownership. For example, even if a person owns a majority of Bitcoin, they don’t inherently have any ownership over the network. Proof of Work also has an implicit sell pressure due to the continuous cost of maintaining mining operations, which allows for healthier and more liquid markets. In Proof of Stake there is no separation between coin and network ownership. Most Proof of Stake networks require that coins be locked with validators to provide security, creating relatively illiquid markets where price movements are more sensitive to changes in demand. Coin supply is artificially reduced through staking, which will cause quicker gains when demand is high, but also quicker losses when demand is low.

Proof of Work systems are also at less risk of hidden attack vectors. If a mining pool increases its mining capacity (hash rate), other pools can retaliate by increasing their own hashrate. There is considerable difficulty in gaining enough hashrate to perform an attack on the protocol. Alternatively, in Proof of Stake systems a single entity can secretly deploy capital to multiple addresses, and accumulate enough coin to own a network with relative ease.

The touted advantage of Proof of Stake is its energy efficiency. But is the trade off worth it? Energy usage vs. security. This revolution is built on the tenets of decentralization, and it is unwise to forsake security for energy efficiency. Mainstream thought downplays the importance of decentralization and scapegoats energy expenditure as a major flaw of Proof of Work protocols to prevent mainstream adoption.

The value of the Proof of Work consensus model security is self-evident in that miners choose to spend money on computation and energy, because the value that a truly trustless protocol brings to the table is worth it. A trustless decentralized system capable of global payment processing with trivial fees and without identity theft risks is something worth the energy expenditure.

Although Bitcoin is more resilient against centralization compared to Proof of Stake protocols, there are still concerns of miner centralization associated with the use of application-specific integrated circuits (ASICs). Graphic card based miners are accessible worldwide allowing for maximal decentralization. ASICs are expensive devices made specifically for mining. They are less accessible than graphic cards and can lead to the centralization of mining.

Ergo uses a mining algorithm, called Autolykos, that was designed to be resistant to ASICs and miner centralization. This alleviates some of the commercial advantage that comes from using specialized technology, and opens competitive mining to the wider commons — anyone with a computer and a graphics card.

With Ethereum’s move to Proof of Stake, Ergo has a massive opportunity to absorb that mining hashrate to elevate the security of the network. The Ethereum foundation is choosing to forsake the miners that have provided security during the network’s growth thus far. Code was law until it wasn’t, and the power is centralized after all.

Ergo respects miner rights and understands the importance of their role in both security and network growth. Collaboration between miners, the decision makers, and builders is necessary for healthy long term growth.

Transactions with eUTXOs

There are two major transaction models used in blockchain: UTXO (unspent transaction outputs) and account models. Like Bitcoin, Ergo uses the UTXO model rather than the account model used by platforms like Ethereum. The short video below will give you a rudimentary explanation of both accounting models.

The UTXO model provides superior:

Privacy: UTXOs are one-time objects, which allow for the formalization of privacy leaks.

Scalability: Parallel processing of transactions is more straightforward in UTXOs compared to account transaction models.

Interoperability: One-time objects are easier to work with when implementing off-chain and side chain protocols.

Transaction cost Predictability: A dominant feature of eUTXOs is that the fees needed for valid transactions can be accurately prophesied before posting it. This eliminates the need for ‘gas’ fees that are used in Ethereum to pay for the computation required to complete a transaction and protect the network from malicious transactions used to flood the network and cause congestion.

Extended UTXO systems enable Ergo (and Cardano) to reclaim Bitcoins’s original transaction model, but with the support of expressive Turing complete smart contracts. A good introductory article to better understand eUTXO can be found here.

Longevity with Storage Rent

Approximately every 4 years Bitcoin sees a halving of block rewards. In 20 to 30 years block rewards will have fallen to the point that miners will have to rely on transactions fees as their primary source of revenue. But will these fees be sufficient to maintaining the security of the network? It is difficult to predict the long term sustainability of Bitcoin with reductions in block rewards.

Some protocols attempt to solve this issue by continuing block rewards, choosing not to fix coin supply. Infinite inflation is an unattractive proposition to most. Digital scarcity is an important feature of Ergo.

Ergo was designed with long-term economic sustainability in mind. Storage Rent is a solution to having both a fixed supply and longevity of block rewards to ensure security in perpetuity. Storage rent is a mechanism that slowly recycles coins from unused wallet addresses at a rate of around 0.13 ERG every 4 years of disuse. The goal is to bring coins that have been permanently taken out of circulation back into the blockchain economy.

It is estimated that today as many as 4 million BTC have been permanently lost. Coins are lost for many reasons, such as the loss of private keys, sending funds to the wrong address or wallet dust. Dust is the small amount of an asset stuck in a wallet, because its value is lower than the cost of a transaction. For example, if a transaction fee is 0.05 ERG then any amount in the wallet less than 0.05 ERG is stuck in the wallet.

In Ergo, while block rewards continue to reduce over the next 18 years, miners will continue to have healthier revenue streams from both transaction fees and storage rent fees on UTXOs. In doing so Ergo will be able to maintain digital scarcity, while giving miners long-term incentives to secure the protocol.

Sigma Protocols and Privacy

The option of privacy must always be available to individuals. Without privacy, society can never be free. People lose their autonomy and fall prey to coercion. Privacy doesn’t need to be forced. Give people the freedom to choose what information they share and what information they want to keep private. Ergo understands the importance of privacy to financial sovereignty and it shows in their implementation of Σ-protocols.

ErgoScript, Ergo’s smart contract language, supports a type of non-interactive zero-knowledge proofs called Σ-protocols and is flexible enough to allow for ring-signatures, multi signatures, multiple currencies, atomic swaps, self-replicating scripts, and long-term computation.

Below is a good metaphor to understand how zero-knowledge proofs function to preserve private information.

Let's say someone picks up a phone in a bar. You can prove it's yours by hiding the screen, entering the unlock code and showing the unlocked screen to the person who found it. This scenario is a simple example of zero-knowledge proof: you have proven you own the phone without revealing any sensitive information.

-Sigma Protocol Documentation

Zero-knowledge proofs allow a party to cryptographically prove to another that they have a piece of knowledge without revealing the knowledge. ErgoMixer is one such privacy application that utilizes Sigma protocols for anonymizing funds.

NiPoPoWs for Accessibility, Scaling and Forking

Ergo has also implemented Non-interactive Proof-of-Proof-of-Work or NiPoPoWs. The most obvious use of NiPoPoWs is to reduce the size of the blockchain. Bitcoin’s blockchain is over 300Gb and Ethereum, with its smart contracts, has a size of over a terabyte. Nodes in these networks need sizeable hard drive space and 1 to 5 days for the nodes to sync. With NiPoPoWs super light clients can sync with a blockchain with less than 1MB of data, reducing the technology requirement to achieve the same security as running a full node.

NiPoPoWs will also enable super efficient operation of side chains. New protocols built on top of the Ergo blockchain can be verified by miners without causing congestion. This technology is at the heart of Ergo’s layer-2 scaling solutions.

The third, and to me the most exciting, advancement by NiPoPoWs is a technology used to upgrade the network called velvet forks. Velvet forks allow for backwards compatible upgrades to the blockchain without the consequences of traditional soft and hard forks.

Even if only a portion of miners implement the latest upgrade, NIPoPoW’s abstraction away from the blockchain allows them to supersede older instances of the protocol without completely removing the unupgraded miners’ ability to secure the network.

Adapting for a New World

Darwin defined evolution by natural selection as “descent with modification.” This ideology isn’t only specific to biological organisms, but can also be used to describe any system that must adapt to survive. Impermanence and change are fundamental to existence. Today the social dynamics related to violence, cooperation, and competition change with the rapidly evolving technological landscape.

Ergo is a network that strives for resilience and longevity through its ideals when building. Ergo has low transaction fees, scaling solutions built into layer 1, optional privacy, and strives for maximal decentralization. Ergo also has the ability to change and adapt to new uncertain social and economic realities of the future.

Nietzsche said, “What doesn’t kill you makes you stronger”. The Ergo community continues to build through the crypto winter and will come through stronger than ever.

Follow me on Twitter @subObjectivity

Contributions are appreciated!

Ergo address: 9f4XwYAHM4WUJM4PnPBA7Va7gB7qg9tb7nwUvfcvVyehscjH1v9

Cardano address: addr1q8fwulcc64vvrnxa0zdwfw4ynk6qf7njzs39v53rpp593z6g3svmpc7m6rtnnye2n2uduc02ft2qe25v07ke58sfc64qc9axyj

Bitcoin address: bc1q3ay68jkgwgvqp8smvpdz49pc9awtdhpy9l45jz

This was a joy to read. Very well written!

Nice article! Ergo definitely seems like the way to go!